By Connie Reguli

We are moving into our 19th month of the official declaration of a pandemic. I was in Washington DC on March 12, 2020 in a citizens lobbying project when we were told all Federal Buildings open to the public were shutting down. When I returned in August 2020 with a small group of citizen lobbyists, thinking that the public offices of the senators and congressmen would now be open, I was shocked to now find buildings all along avenues around the Federal block were not only closed but boarded up. Closed. Closed. Closed.

I went to Washington DC in September, October, November, and December in 2020. On each trip the sights of DC was more and more depressing. Plywood, fencing, police, sirens, flocks of violent ANTIFA…. It reached its peak in January when I retired for the Jan 6 rally. By early morning on Jan 7 an eight foot fence was erected around the Capitol.

As citizens who cared about freedom, we were shocked and dismayed at where we were. Surviving the pandemic was only part of our struggles for Americans. Now our freedoms were at risk.

But now let’s talk about the economy and the pandemic.

First unemployment. President Trump supporters watched the unemployment rates dropped systematically during his tenure. In February 2020, unemployment rates were at a historic low of 3.5%. As soon as the country was shut down by governors all over the US, unemployment shot up to 14.4%.

In response the the massive shut down, Congress passed the first economic relief package. Now, do not forget that is you tax dollars. this included a massive distribution for unemployment benefits and the PPP (payroll protection plan) to businesses to keep employees on the payroll even though they did not have the revenue to support the payroll. (A basic business economic principle.)

A second waive of unemployment and PPP occurred in early 2021. The total push of tax dollars into the day to day economy exploded.

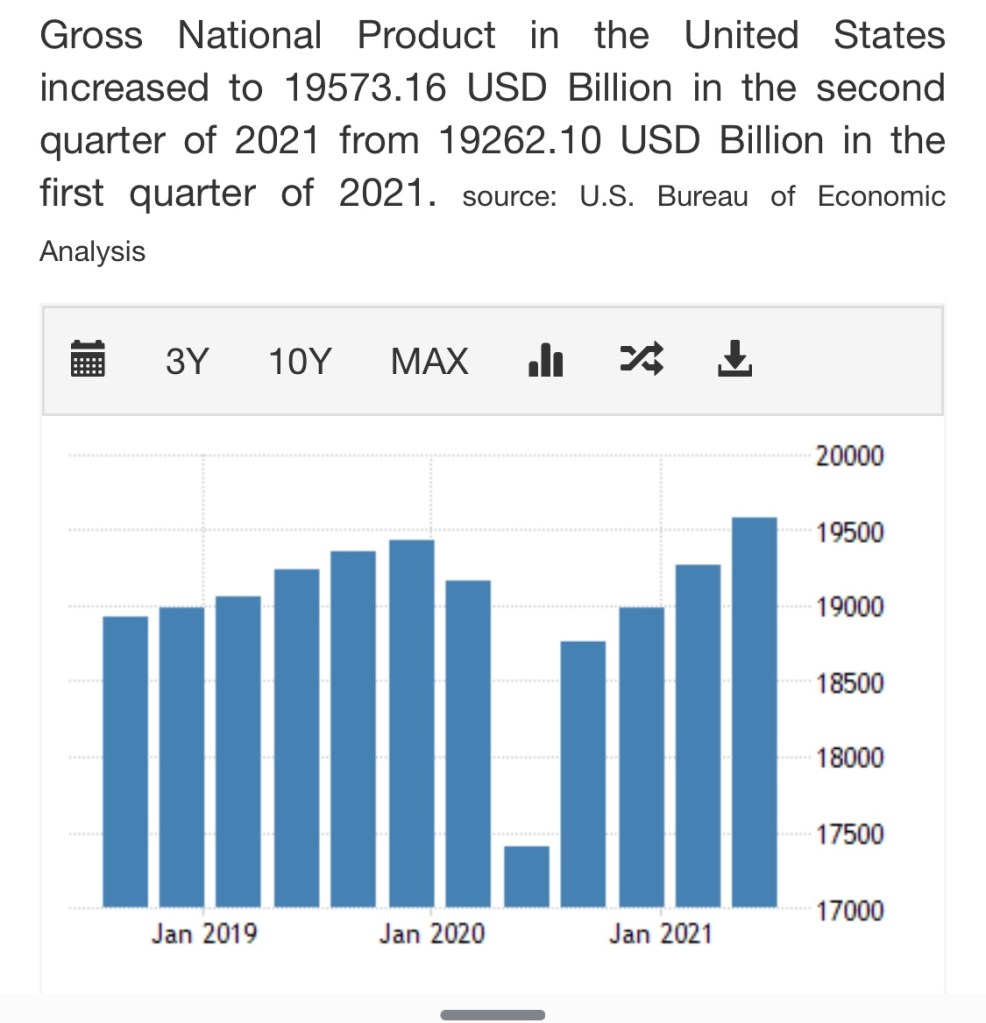

The gross national product (GNP), which has exponentially grown over the last century took a dive in The last quarter of 2020 which means the commercial goods and services crashed when businesses were shut down.

If you are putting this together in you head, you can see that the recovery of the economic measures was due in large part to pushing tax dollars back into the economy and NOT due to an increases in market transactions.

Now, let’s move on. What you need to also see is that the stock market has also soared while the everyday working class has suffered from loss of employment.

I am assuming that you are not a sophisticated economist and neither am I, but I want you to see a bit of what is happening.

Just a month ago, Frontline published a four part series on Wall Street, debt, banking, and the Fed. If you want to increase you understand this better watch these.

Part One Money Power and Wall Street. President Clinton and deregulation.

Part Two The fall of Bear Stearnes and Ben Bernanke, Chair of the Fed (2006-2014). The bailout. President Obama’s Cooper Union speech. The fall of Lehman Bros. The taxpayer bailout of AIG insurance costing taxpayers $180 billion. Then in 2008, $700 billion of tax dollars were handed to Sec of treasury Paulson for TARP. The US government became an investor in the banks.

Part Three President Obama’s honeymoon with Wall Street.

As you watch these you will see that high roller bankers and brokers trade “a hope and a prayer” and NOT real economic growth.

Before President Clinton left office he deregulated banking allowing them to join brokerage firms or start their own brokerage activities. That moved bankers (generally believed to be conservative secure institutions) into the area of high risk stock trading.

Derivatives, sub-prime loans, financial shell games, credit default swaps, CDOs, TARP, moral hazard, traunching, … all words to add to your vocabulary to understand the financial world. It is not about dollars 💵 and cents, but about paper 📑 transactions with little relationship to industrial 🏭 growth or goods and services.

The result was a housing crises of 2008 in which we saw mortgage defaults by the thousands leaving homes abandoned and the populace crushed financially. Any small amount of equity they accumulated was gone. Sub-prime mortgages became toxic “assets”. The market stopped trading the mortgages that had been packaged in bundles. These mortgages were made to people who could not pay, based on inflated housing values, and high interest rates.

You will see that The Fed (the Federal Reserve Bank) creates money, erases debt, and manipulates the economy.

As I work my way through these I will add to this post with some summaries.

God Bless